Welcome to the December edition of Money While You Sleep. The marker ended the year very strong. More on that shortly. Here is what we have been up to:

- Took a trip to Jasper for a few days just to get away.

- Got the kids out on the hill!

- Enjoyed a relatively quiet Christmas.

Here are a few pictures

Portfolio details:

This month the TSX went up going from $17,190.25 to $17,464.70, an increase of 1.6%.We came in at an increase of 2.4% in the month. We are currently 63% bluechip, 30% Growth and 7% cash! Made a couple moves in the month.

Quick trades

Bought DOC.V 500 @ $2.07 and Sold at $2.20

Bought VSR.V 500 @ $1.14 and Sold at $1.31

Please note that I only do this with companies I’m comfortable holding for a long period of time.

Sold

Sold Polaris Infrastructure 163@ $18.56

Who is PIF.TO

Polaris Infrastructure Inc., a renewable energy company, acquires, explores for, develops, and operates geothermal and hydroelectric energy projects in Latin America. The company, through its subsidiaries, owns and operates the San Jacinto project, a 72 megawatt (MW) net capacity geothermal facility located in northwest Nicaragua. Its exploration and development property includes the Casita San Cristobal project comprising an exploration concession with an area of 100 square kilometers located in northwest Nicaragua. Polaris Infrastructure Inc. also operates run-of-river (ROR) hydro facility of 5 MW in Canchayllo, Peru; and 2 ROR hydro projects with the capacity of approximately 8 MW (net) and 20 MW (net) in Peru. The company was formerly known as Ram Power, Corp. and changed its name to Polaris Infrastructure Inc. in May 2015. Polaris Infrastructure Inc. was incorporated in 1984 and is based in Toronto, Canada.

Our Why:

We have been buying this every time it went below $14.00. It went on a big run but does pose risk based on locations. We feel its ahead of itself. This was a nice profit and collected solid dividends along the way. They have renewed their contracts with government officials but the new contract isn’t as exciting as the last one.

Sold half our position in Lightspeed POS Inc by selling 35 shares at $73.85

Who is LSPD.TO

Lightspeed POS Inc. provides commerce enabling Software as a Service (SaaS) platform for small and midsize businesses, retailers, restaurants, and golf course operators. Its SaaS platform enables customers to engage with consumers, manage operations, accept payments, etc. The company’s solutions cover front-end customer experience that include point of sale, omni-channel engagement, home delivery, and order and loyalty management, as well as management of discounts, price rules, and gift cards; back-end operations management comprising product and menu, inventory, bookings and membership, customer, employee, accounting, floor and table, workflow, reporting and analytics, and real-time dashboard; and integrated payment gateway solutions. It also sells a suite of third-party hardware products to complement its software solutions for the retail and hospitality segments, such as customer facing displays, stands, barcode scanners, receipt printers, cash drawers, payment terminals, and an assortment of other accessories. The company was formerly known as LightSpeed Retail Inc. and changed its name to Lightspeed POS Inc. in October 2014. Lightspeed POS Inc. was founded in 2005 and is headquartered in Montréal, Canada.

Our Why:

This stock has shot up like a rocket. We decided to sell half as it has more than doubled from our original purchase price. The remaining shares have now cost us nothing and we are happy to hold them moving forward.

Bought

Opened up a small position in Score Media and Gaming Inc. by purchasing 600 shares @ $1.60

Who is SCR.TO:

Score Media and Gaming Inc. operates as a sports media company in North America. It offers theScore, a mobile sports application that delivers customizable news, scores, stats, and notifications for various leagues and sports; and theScore esports, which produces and shares original video content pieces across its web and social platforms, including features and documentaries on high-profile teams, games, and players from across the esports scene, as well as highlights and interviews. The company also provides theScore Bet, a mobile sports betting platform that delivers various pre-game and in-game markets and betting options, lightning-fast scores, and in-game data comprising early cash-out, and easy and secure deposit and withdrawal options. In addition, it operates theScore.com, a web platform that provides sports news, scores, and video and editorial content written by original sports voices. The company was incorporated in 2012 and is based in Toronto, Canada.

Our why:

Score media has been around for a long time with millions of active users on their app. As government officials all over the world have made it clear they will allow single sports betting in the near future I believe the Score with take a piece of the market share in that world. Currently this is only legalized in a couple states however Canada has made it clear that they have had a change of heart along with other locations. Here are a couple articles and if you search you will find many more. This could be volatile.

https://www.cbc.ca/news/politics/legalize-single-event-sports-betting-1.5816059

Added to Kirkland Lake Gold by purchasing 20 shares at an average share price of $50.44

Who is KL.TO:

Kirkland Lake Gold Ltd. engages in the acquisition, exploration, development, and operation of gold properties. The company’s principal properties include the Fosterville Mine located in the State of Victoria, Australia; and Macassa Mine situated in the Municipality of Kirkland Lake, Ontario, Canada. It has a strategic alliance agreement with Newmont Corporation to assess regional exploration opportunities around Newmont’s Timmins properties and the company’s Holt Complex in Ontario, Canada. The company was formerly known as Newmarket Gold Inc. and changed its name to Kirkland Lake Gold Ltd. in December 2016. Kirkland Lake Gold Ltd. is headquartered in Toronto, Canada.

Our why:

Kirkland maybe the best purchase of the gold companies we have acquired. Again we ran some numbers comparing the first 9 months of 2020 against 2019, this is what we found. Revenue is up 83%, cost of sales is the best of the large caps (over 12B market caps) at 43%, zero debt which helps earnings in a big way (You heard that right!), total assets up 167%, increased dividend 100% in 1st quarter followed by another 50% increase in 3rd quarter. This puts KL’s payout ratio around 15% giving plenty of room to increase in the future. So were going through a pandemic and KL is increasing their dividend at an insane amount while others are cutting and suspending. No brainer for me. Recent earning can be found at sedar.com or yahoo for a quick overview right here. Here is the latest article which will help their future.

https://ca.finance.yahoo.com/news/kirkland-lake-gold-reports-wide-181100801.html

Dividend increases and decreases

- No Cuts

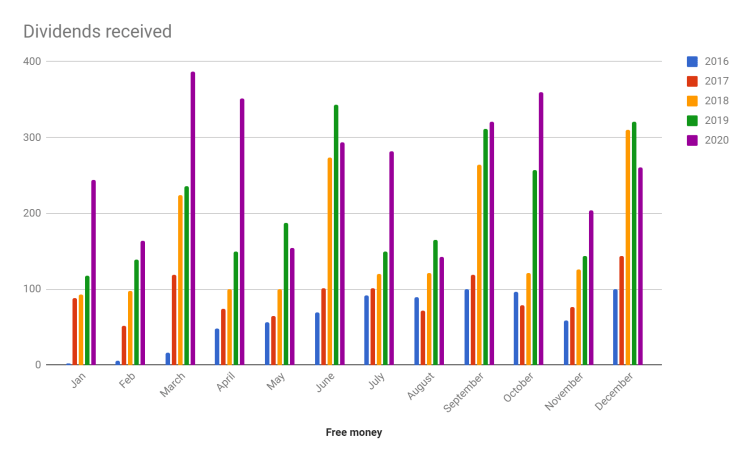

2016 – 2017 – 2018 – 2019 – 2020 Dividends and Rebates received

December dividends came in at $260.92 which is a decrease YOY. This kept us in line with our 2020 goal of receiving over $3,100 in dividends.

Dividends received

| Stock List | Dividend | Drip | Account |

| RUS.TO | $41.42 | Yes | TFSA 1 |

| BPY.UN | $55.63 | Yes | TFSA 1 |

| MFC.TO | $52.64 | Yes | TFSA 1 |

| XTC.TO | $30.69 | Yes | TFSA 1 |

| SU.TO | $13.86 | Not enough | TFSA 1 |

| FRU.TO | $1.76 | No | TFSA 1 |

| EXE.TO | $7.28 | Yes | TFSA 1 |

| CSH.UN | $15.91 | Yes | TFSA 1 |

| ALA.TO | $5.36 | Not enough | TFSA 1 |

| PLZ.UN | $10.03 | Yes | TFSA 1 |

| NPI.TO | $14.10 | Not enough | TFSA 1 |

| SIS.TO | $5.40 | Not enough | TFSA 1 |

| EIF.TO | $6.84 | Not enough | TFSA 1 |

| ABX.TO | $15.22 | Not enough | TFSA 2 |

| Total: | $204.36 | |

My thoughts moving forward

Current economy conditions

Canada unemployment rates are starting to improve by going from 12.3% in June to 8.5% in December. January and February numbers will tell us the story moving forward.

As you can see another purchase in the Gold sector was made. With vaccines hitting the market and it possibly taking until late third quarter to get out to all the printing machine will more than likely be running again. We are going to take a cautious approach going into 2021. We will be staying up to date on the news and add to only companies were highly confident in.

Sectors I like

- Financials

- Communications

- Healthcare

- Technology

- Utilities

- Basic metals

What to look for

We saw many companies completely take off in 2020, from Telehealth, communications/technology such as Zoom to basic metals. How much of this will continue remains to be seen. 4th quarter results will be key to determining which companies are ahead of themselves and which ones are solid value plays.Here are a few things to look for:

- What do 4th quarter current revenues look like in comparison to last years 4th quarter? How about quarter over quarter?

- Have assets dropped?

- Whats forward guidance look like going into 2021?

- Have liabilities taken a turn for the worse? Any additional debt taken on? If so at what interest rate, short term or long term?

- How do assets compare to liabilities?

- What is shareholder equity vs. market cap and current growth plans?

- Did you read the full report? This is important so you don’t miss something, it’s your hard earned money your investing so you want to be sure there are no bad apples in the small print.

Keep an eye on earnings vs analysts expectations. Look for any forward guidance in the report that can help you better understand what management expects over the next few quarters. When checking if the dividend is in good shape focus on three metrics, Free Cash Flow %, Operating Cash Flow % and Payout Ratio %, these metrics can help determine the health of the current dividend.

Current companies I’m watching, which I’ve added 5 to the list. I own many of these but don’t have a full position that’s why they are still on the list.

ARE.TO, EQB.TO, SLF.TO, NWH.UN.TO, FTS.TO,CPX.TO, AQN.TO, T.TO, NFI.TO,BCE.TO, POW.TO, DOC.V, REAL.TO,SCR.TO,NVEI.TO,KL.TO, ABX.TO,WELL.TO

Thanks for reading and feel free to leave a comment!

Invest in yourself

Brian

Disclosure: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. Please ensure you do your own research.